Orphan Drugs Show Blockbuster Potential

The Economic Power of Orphan Drugs, (Thomson Reuters, August 23, 2012), reveals that today’s blockbuster drugs are not the only money makers by comparing the total projected value of orphan and non-orphan drugs from 1990 to 2030. This analysis is based on a peer-reviewed study from Drug Discovery Today.

Following are some of the key findings:

Orphan Drugs Show Blockbuster Potential: The average total present value of orphan drugs is $637 million; compared with $638 million for non-orphan drugs. On the whole, the orphan drug market was valued at $50 billion globally at the end of 2011.

Orphan Drug Growth to Outpace Non-Orphan Drug Growth: The compound annual growth rate for the orphan drug market between 2001 and 2010 was 25.8%, compared to only 20.1 percent for a matched control group of non-orphan drugs. This data, combined with the increasing number of orphan drug approvals suggest that the growth rate of launched orphan drugs will outshine that on non-orphans over the next 30 years.

Cost Offsets Population Size: The analysis demonstrates that the impact of the smaller patient population is offset by the higher price demanded by orphan drugs. In 2010, the industry’s most expensive drug, Soliris, which costs more than $409 thousand per year for treatment of a rare blood disease brought in $541 million in total sales for Alexion Pharmaceuticals.

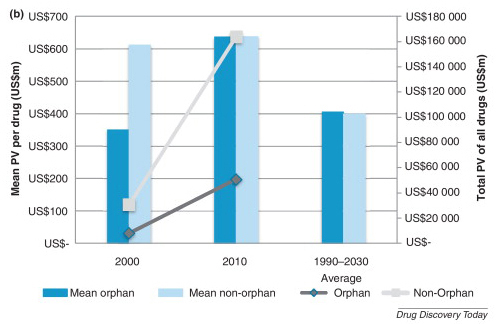

Figure 1. Present value (PV) analysis of orphan and non-orphan drugs suggests increasing value of orphan drugs. The mean value of an orphan drug increased from US$351m in 2000 to US$637m in 2010. By contrast, the mean value of a non-orphan drug remained approximately constant at just over US$600m. Over the entire 1990–2030 forecast period, the mean per-year economic value for an orphan drug was US$406m, compared with US$399m for a non-orphan drug (b).